Graphene: The Future-Proof Core System

Graphene: The Future-Proof

Core System

Graphene: The Future-Proof Core System

Graphene is the modular insurance core system that powers the full insurance value chain and product spectrum. Graphene adjusts to your needs – whether you want to build a greenfield insurance venture or holistically modernize your core system and operations.

Graphene is the modular insurance core system that powers the full insurance value chain and product spectrum. Graphene adjusts to your needs – whether you want to build a greenfield insurance venture or holistically modernize your core system and operations.

Graphene is the modular insurance core system that powers the full insurance value chain and product spectrum. Graphene adjusts to your needs – whether you want to build a greenfield insurance venture or holistically modernize your core system and operations.

Leading Insurers Chose Graphene

Leading Insurers Chose Graphene

Leading Insurers Chose Graphene

End-to-end Capabilities

Modular deployment of modules across the full value chain to fit your needs and architecture.

Product Management

Comprehensive no-code product management capabilities across life, health and P&C, allowing insurers to quickly set-up and iterate innovative and traditional insurance products.

Comprehensive no-code product management capabilities across life, health and P&C, allowing insurers to quickly set-up and iterate innovative and traditional insurance products.

Comprehensive no-code product management capabilities across life, health and P&C, allowing insurers to quickly set-up and iterate innovative and traditional insurance products.

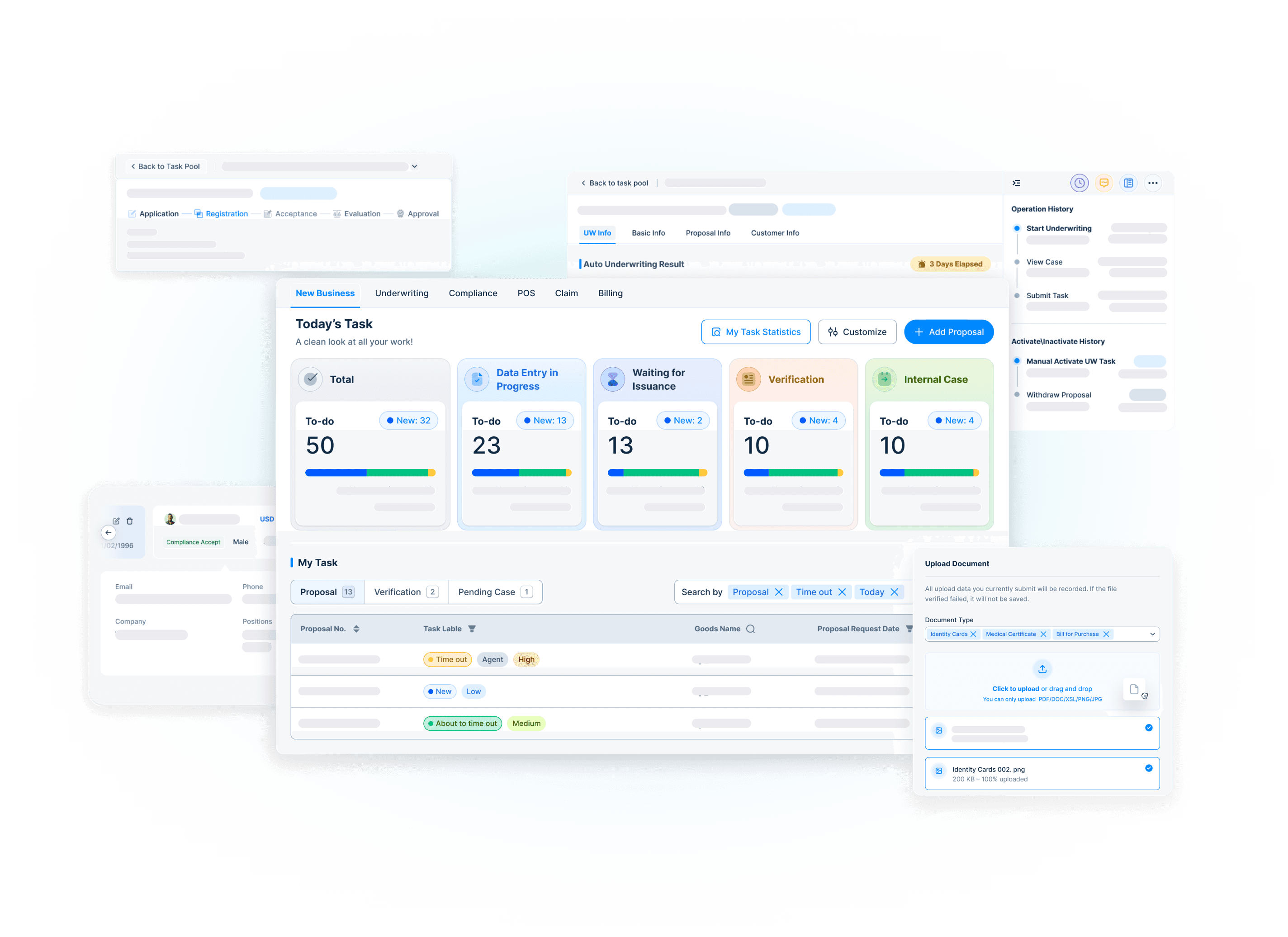

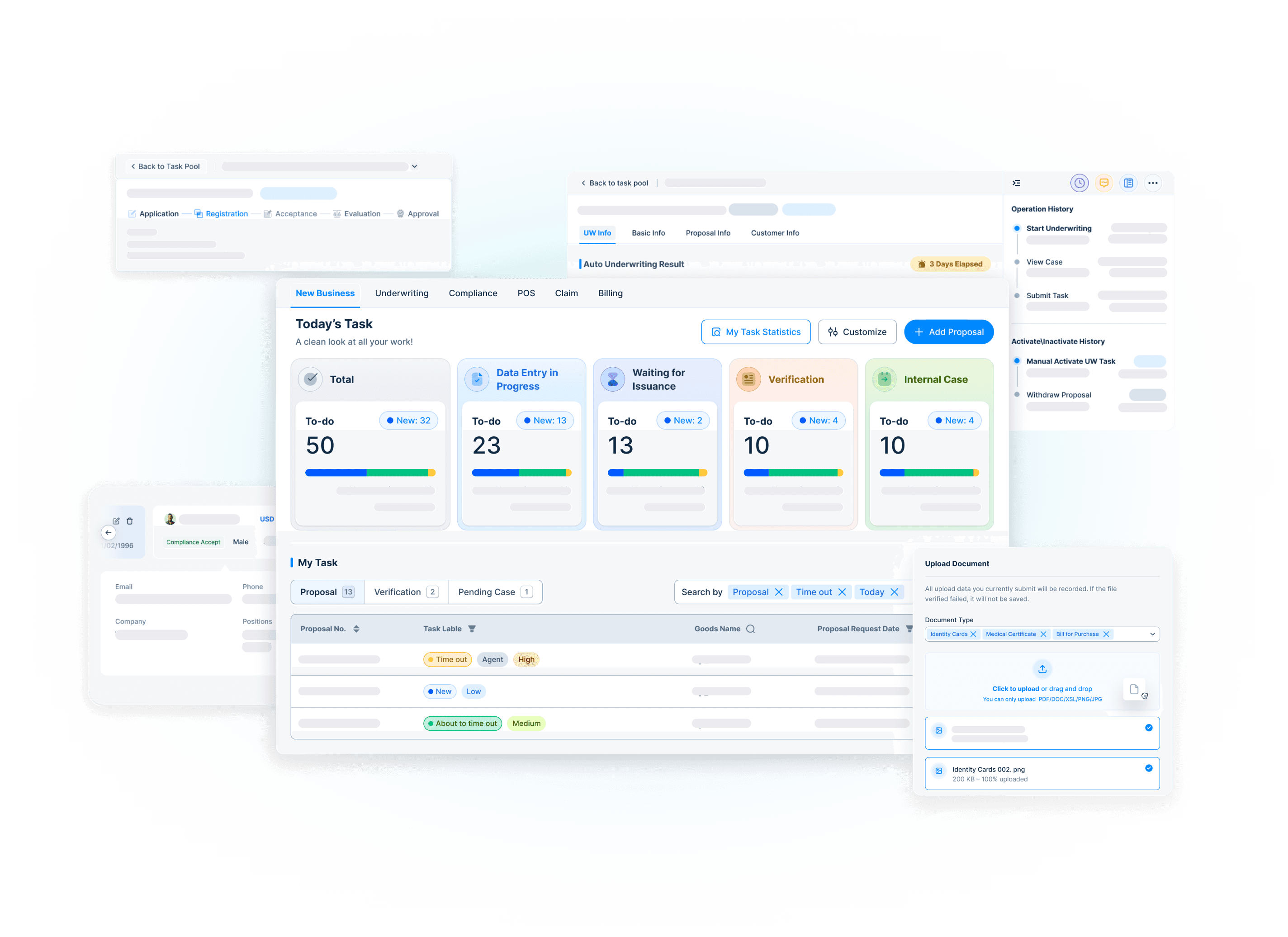

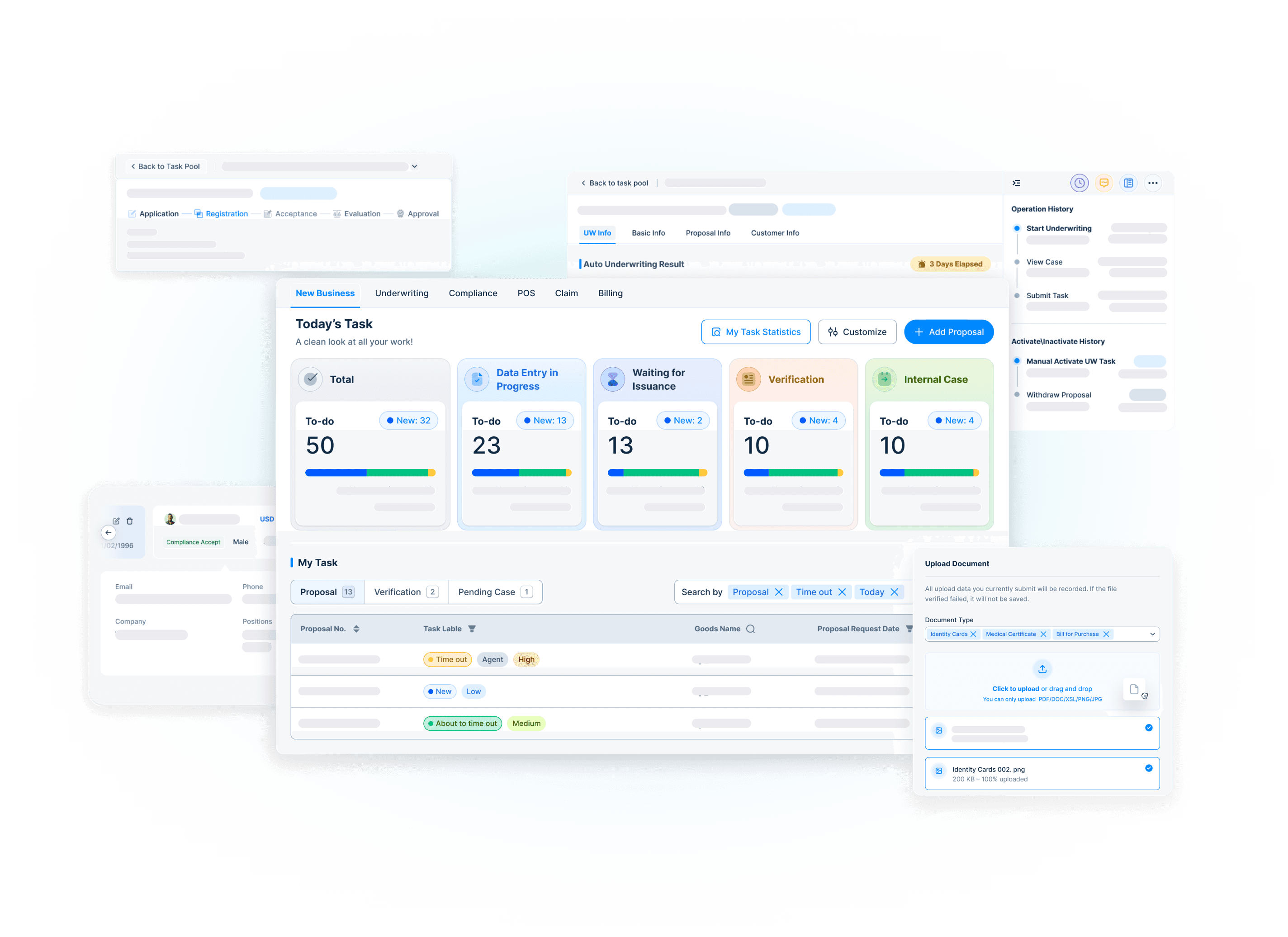

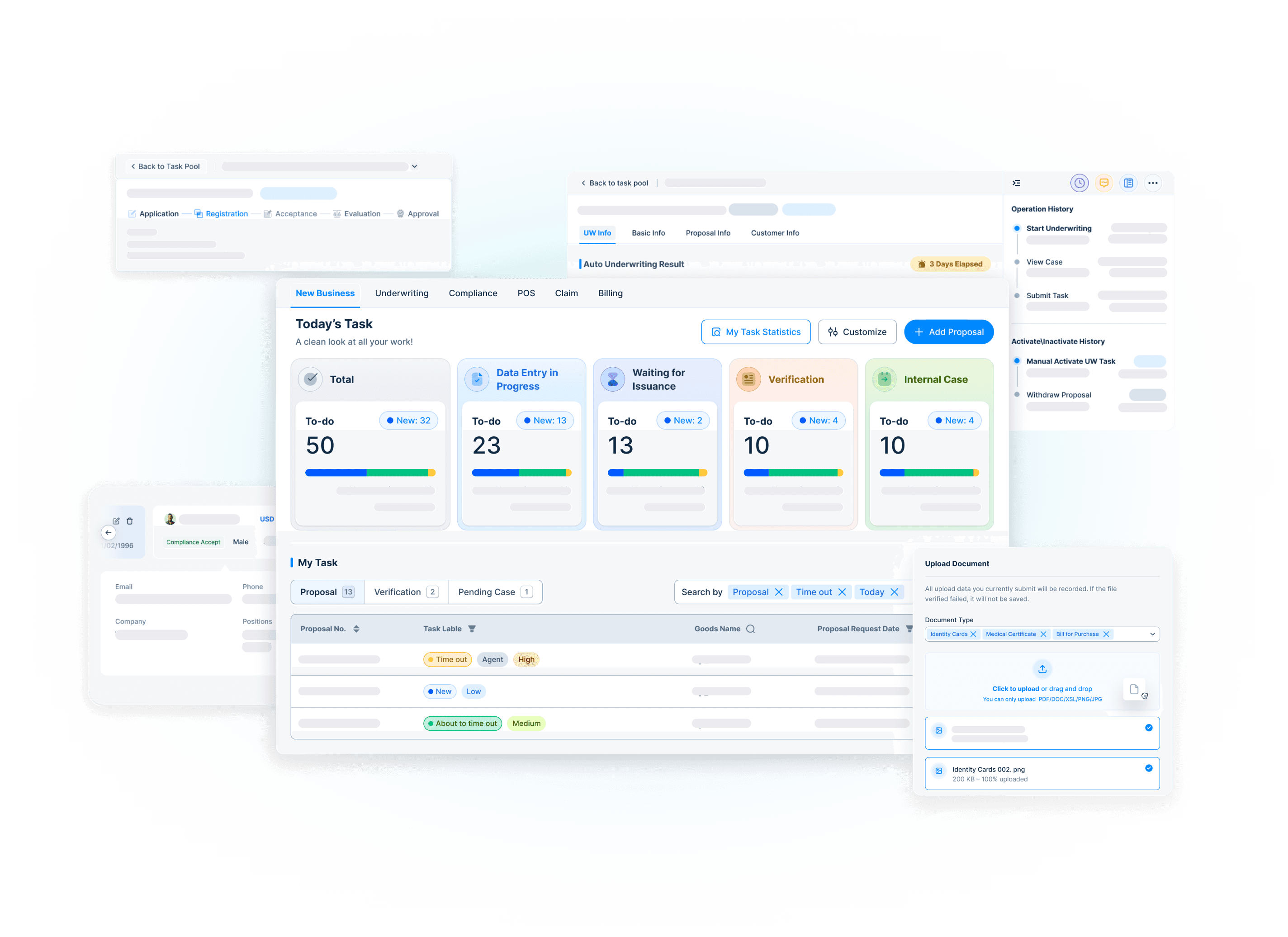

Underwriting & Rating

Comprehensive underwriting workbench, rating engine and rule engine to accelerate and automate quote and bind processes, while improving decision making.

Comprehensive underwriting workbench, rating engine and rule engine to accelerate and automate quote and bind processes, while improving decision making.

Comprehensive underwriting workbench, rating engine and rule engine to accelerate and automate quote and bind processes, while improving decision making.

Policy Administration

Full policy administration capabilities with workflow automation across the policy lifecycle – enabling straight-through processes for new business, endorsements, renewals, reinstatements, and cancellations.

Full policy administration capabilities with workflow automation across the policy lifecycle – enabling straight-through processes for new business, endorsements, renewals, reinstatements, and cancellations.

Full policy administration capabilities with workflow automation across the policy lifecycle – enabling straight-through processes for new business, endorsements, renewals, reinstatements, and cancellations.

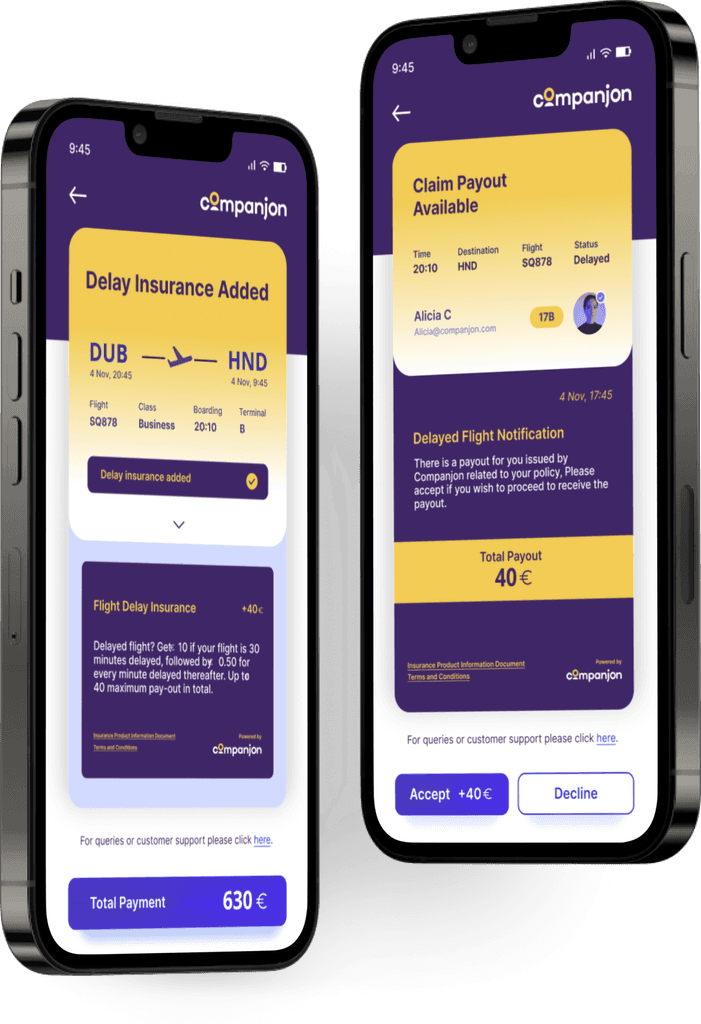

Claims & Benefits

End-to-end solution to manage the entire claims and benefits lifecycle – from first-notice-of-loss to reserving to settlement. Intelligent automation tools and full support for parametric claims scenarios.

End-to-end solution to manage the entire claims and benefits lifecycle – from first-notice-of-loss to reserving to settlement. Intelligent automation tools and full support for parametric claims scenarios.

End-to-end solution to manage the entire claims and benefits lifecycle – from first-notice-of-loss to reserving to settlement. Intelligent automation tools and full support for parametric claims scenarios.

Finance & Billing

Diverse billing options supporting complex scenarios across product lines. Flexible payment and disbursement options – across traditional and digital payment rails. Streamlined commission management.

Diverse billing options supporting complex scenarios across product lines. Flexible payment and disbursement options – across traditional and digital payment rails. Streamlined commission management.

Diverse billing options supporting complex scenarios across product lines. Flexible payment and disbursement options – across traditional and digital payment rails. Streamlined commission management.

Insights & Analytics

Built-in big data and analytics platform to distil real-time insights from large quantities of data – across all modules in Graphene. Machine learning platform to build, train and run your models.

Built-in big data and analytics platform to distil real-time insights from large quantities of data – across all modules in Graphene. Machine learning platform to build, train and run your models.

Built-in big data and analytics platform to distil real-time insights from large quantities of data – across all modules in Graphene. Machine learning platform to build, train and run your models.

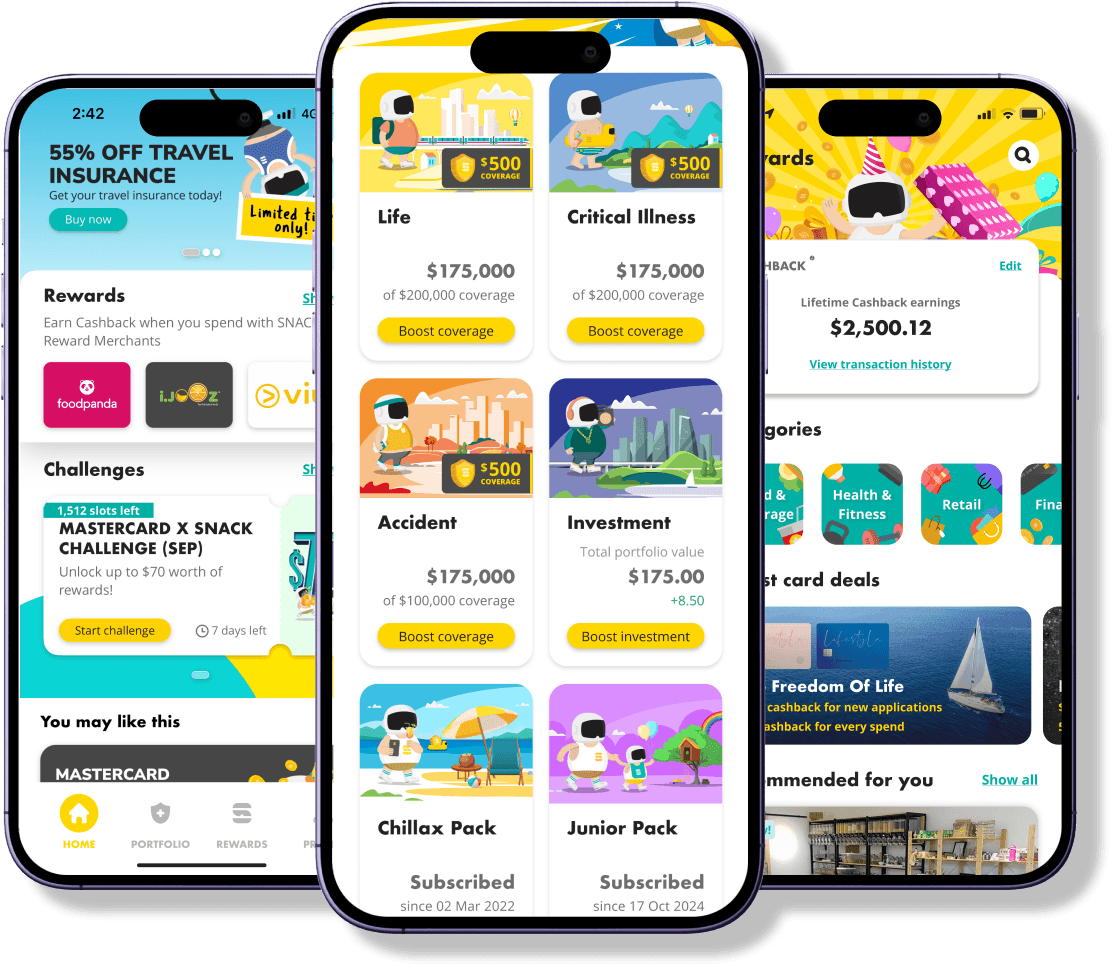

Digital Engagement

Journey and portal builder for policyholders, agents, and financial advisors to deliver seamless digital sales, servicing, and claims journeys – from simple digital P&C products to complex investment-linked savings products.

Journey and portal builder for policyholders, agents, and financial advisors to deliver seamless digital sales, servicing, and claims journeys – from simple digital P&C products to complex investment-linked savings products.

Journey and portal builder for policyholders, agents, and financial advisors to deliver seamless digital sales, servicing, and claims journeys – from simple digital P&C products to complex investment-linked savings products.

Case Studies

Book a Demo

Speak to our experts and discover how Graphene can help you unlock tangible value.

Book a Demo

Speak to our experts and discover how Graphene can help you unlock tangible value.

Book a Demo

Speak to our experts and discover how Graphene can help you unlock tangible value.

Book a Demo

Speak to our experts and discover how Graphene can help you unlock tangible value.

Delivering Tangible Benefits

Enabling you to innovate and operate more efficiently and effectively.

Increased Operational Efficiency

Dynamic workflows and AI tools to automate processes across the value chain, delivering cost savings and improved user experience.

Limitless Proposition Innovation

Flexibility to innovate across traditional and digital business models, including usage-based, parametric and accumulator products.

Limitless Product Innovation

Flexibility to innovate across traditional and digital business model, including usage-based, parametric and accumulator products.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Increased Operational Efficiency

Dynamic workflows and AI tools to automate processes across the value chain, delivering cost savings and improved user experience.

Limitless Proposition Innovation

Flexibility to innovate across traditional and digital business models, including usage-based, parametric and accumulator products.

Limitless Product Innovation

Flexibility to innovate across traditional and digital business model, including usage-based, parametric and accumulator products.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Increased Operational Efficiency

Dynamic workflows and AI tools to automate processes across the value chain, delivering cost savings and improved user experience.

Limitless Proposition Innovation

Flexibility to innovate across traditional and digital business models, including usage-based, parametric and accumulator products.

Limitless Product Innovation

Flexibility to innovate across traditional and digital business model, including usage-based, parametric and accumulator products.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Built for the Digital Reality

Built from day 1 for digital and embedded insurance to enable innovative propositions and seamless customer journeys. Digital-first approach extended to cover traditional insurance models and to accelerate the digital transformation across your full value chain.

Whitepaper

Graphene's Role in Enhancing Omni-Channel Success in Insurance

Graphene's Role in Enhancing Omni-Channel Success in Insurance

Technological Prowess

Technological Prowess

State-of-the-art and future-proof tech stack ensuring peak scalability, reliability, usability, and security.

Cloud-Native and Cloud-Agnostic

Built for the cloud with high availability, auto-scaling, and proven multi-tenant capabilities. Available on all major cloud vendors.

Microservices and Open Architecture

Full microservices design to support modular deployment and flexible scaling. Open API platform for seamless integrations.

Ingrained Security and Data Protection

Mature DevSecOps with security ingrained into every process. ISO27001 certified and GDPR compliant. Hardened Docker images.

Evergreen Tech Stack

Modern open-source frameworks and components. Continuous updates proven by bi-weekly releases on our multi-tenant SaaS.

Modern open-source frameworks and components. Continuous updates proven by bi-weekly UAT-free releases on our multi-tenant SaaS instances.

Cloud-Native and Cloud-Agnostic

Built for the cloud with high availability, auto-scaling, and proven multi-tenant capabilities. Available on all major cloud vendors.

Microservices and Open Architecture

Full microservices design to support modular deployment and flexible scaling. Open API platform to manage seamless integrations.

Ingrained Security and Data Protection

Mature DevSecOps with security ingrained into every process. ISO27001, ISO20000, and ISO9000 certifications and GDPR compliance.

Evergreen Tech Stack

Modern open-source frameworks and components. Continuous updates proven by bi-weekly UAT-free releases on our multi-tenant SaaS instances.

Evergreen Tech Stack

Modern open-source frameworks and components. Continuous updates proven by bi-weekly UAT-free releases on our multi-tenant SaaS instances.

Cloud-Native and Cloud-Agnostic

Built for the cloud with high availability, auto-scaling, and proven multi-tenant capabilities. Available on all major cloud vendors.

Microservices and Open Architecture

Full microservices design to support modular deployment and flexible scaling. Open API platform to manage seamless integrations.

Ingrained Security and Data Protection

Mature DevSecOps with security ingrained into every process. ISO27001, ISO20000, and ISO9000 certifications and GDPR compliance.

Evergreen Tech Stack

Modern open-source frameworks and components. Continuous updates proven by bi-weekly UAT-free releases on our multi-tenant SaaS instances.

Evergreen Tech Stack

Modern open-source frameworks and components. Continuous updates proven by bi-weekly UAT-free releases on our multi-tenant SaaS instances.

Delivering Tangible Benefits

Enabling you to innovate and operate more efficiently and effectively.

Increased Operational Efficiency

Dynamic workflows and AI tools to automate processes across the value chain, delivering cost savings and improved user experience.

Digital Wallet Integration

Link your digital wallet to streamline transactions and manage all your financial activities in one place. For all Digital Wallet you know.

Investment Insight

Access intelligent investment insights tailored to your risk tolerance and financial aspirations. Stay informed about market trends, and invest suggestions.

Increased Operational Efficiency

Dynamic workflows and AI tools to automate processes across the value chain, delivering cost savings and improved user experience.

Digital Wallet Integration

Link your digital wallet to streamline transactions and manage all your financial activities in one place. For all Digital Wallet you know.

Investment Insight

Access intelligent investment insights tailored to your risk tolerance and financial aspirations. Stay informed about market trends, and invest suggestions.

Product Management

Comprehensive no-code product management capabilities across life, health and P&C, allowing insurers to quickly set-up and iterate innovative and traditional insurance products.

Underwriting & Rating

Comprehensive underwriting workbench, rating engine and rule engine to accelerate and automate quote and bind processes, while improving decision making.

Policy Administration

Full policy administration capabilities with workflow automation across the policy lifecycle – enabling straight-through processes for new business, endorsements, renewals, reinstatements, and cancellations.

Product Management

Comprehensive no-code product management capabilities across life, health and P&C, allowing insurers to quickly set-up and iterate innovative and traditional insurance products.

Underwriting & Rating

Comprehensive underwriting workbench, rating engine and rule engine to accelerate and automate quote and bind processes, while improving decision making.

Policy Administration

Full policy administration capabilities with workflow automation across the policy lifecycle – enabling straight-through processes for new business, endorsements, renewals, reinstatements, and cancellations.

End-to-end Capabilities

Modular deployment of modules across the full value chain to fit your needs and architecture.

Peak3 is not affiliated, associated, authorized, endorsed by, or in any way connected with Peak Reinsurance Company Limited.

Social Media

© 2026 Peak3. All rights reserved

Peak3 is not affiliated, associated, authorized, endorsed by, or in any way connected with Peak Reinsurance Company Limited.

Social Media

© 2026 Peak3. All rights reserved

Peak3 is not affiliated, associated, authorized, endorsed by, or in any way connected with Peak Reinsurance Company Limited.

Social Media

© 2026 Peak3. All rights reserved

Peak3 is not affiliated, associated, authorized, endorsed by, or in any way connected with Peak Reinsurance Company Limited.

Social Media

© 2026 Peak3. All rights reserved